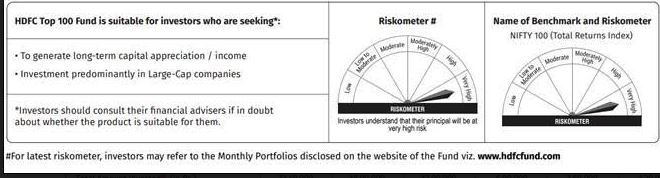

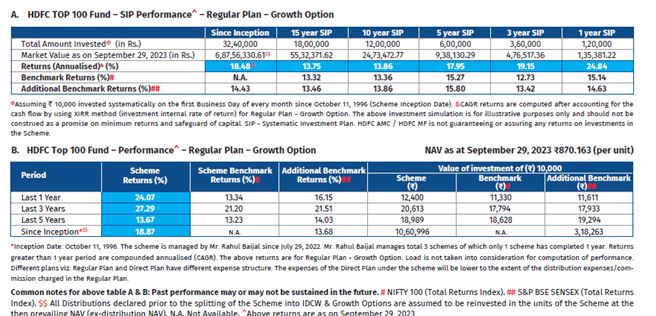

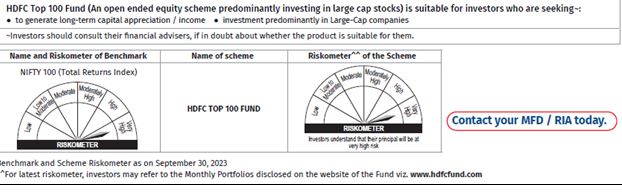

Bangalore,22nd Nov 2023: HDFC Top 100 Fund, an open-ended equity scheme predominantly investing in large-cap stocks (“the Fund”), has successfully completed 27 years of operation in 2023. Over the past 27 years, the Fund hasdelivered Compound Annual Growth Rate (CAGR) of ~19%. Further, a SIP of Rs 10,000 invested systematically on the first business day of every month (total investment Rs 32.40 Lacs) in HDFC Top 100 Fund would have grown to Rs. 6.88 crores by September 29, 2023(See complete performance details below). This performance is a testament to the fund’s ability to navigate market fluctuations and deliver steady growth to investors.

The portfolio construction follows a bottom up approach to stock picking blended with top down sector and macro trends. The Fund follows a diversified style with a blend of GARP (growth at reasonable price) and value. In stock selection, the focus is on qualityof business models, management and financial metrics. Portfolio construction is based on risk-reward of opportunities available at anygiven point in time. As per the mandate, more than 80% of the portfolio always remains invested in the well-established large capcompanies.The core of the portfolio construction is from a medium to long term perspective. The strategy will be in line with ourphilosophy of maintaining a disciplined approach of looking for quality companies at reasonable valuations.

There is lot of focus on risk management with activepositions being taken in a controlled manner while ensuring compliance with regulatory and internal risk guidelines. Any high conviction bets are taken after a consideredevaluation of the company’s positioning in the industry and the business cycle and regularly evaluated.The portfolio is well diversifiedin number of stocks and the fund manager takes measured sector deviations calls vs benchmark.

Large-cap stocks have historically demonstrated stability during economic fluctuations and have had better risk reward ratios.Further, the large cap index has outperformedmid and small cap indices in 7 out oflast 17 calendar years.Also, given the recent sharp outperformance of mid and small caps over large caps, the large cap segment now seems to be relatively attractive in terms of valuations and investors with medium to long term view may consider investing in HDFC Top 100 Fund.

Rahul Baijal, Senior Fund Manager – Equities, HDFC Mutual Fund, said “HDFC Top 100 Fund’s consistent performance over the past 27 years is a testament to our rigorous research, disciplined investment approach, and a focus on well-established businesses. Large-cap stocks offer stability and better risk adjusted return, making them an attractive option for investors looking for investment opportunities over the long term.”

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.